In this week’s recap: Stocks lagged after another week with no fiscal stimulus; the labor market seemed to improve despite a rise in COVID-19 cases.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |October 26, 2020

THE WEEK ON WALL STREET

The failure to reach an agreement on a new fiscal stimulus bill soured investor sentiment and sent stocks modestly lower for the week.

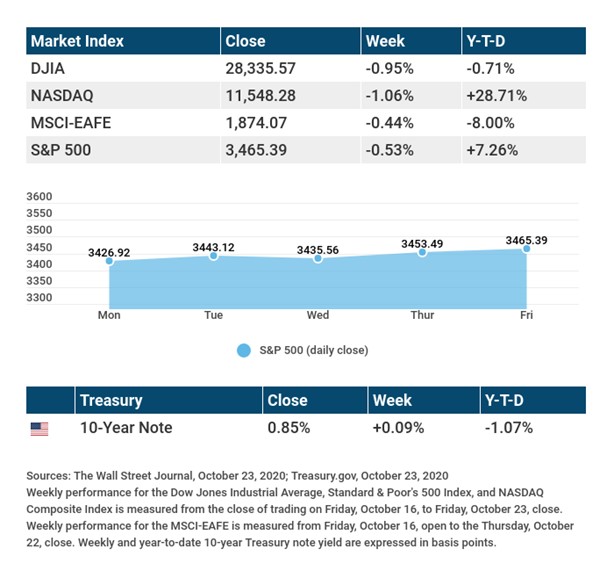

The Dow Jones Industrial Average fell 0.95%, while the Standard & Poor’s 500 lost 0.53%. The Nasdaq Composite index slipped 1.06% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 0.44%. 1,2,3

Markets Disappointed with Stimulus Impasse

Stock prices ebbed and flowed all week, pulled by the gravity of fiscal stimulus talks in Washington, D.C. As investors saw improving prospects for a new fiscal stimulus bill, stocks rose. As prospects dimmed, stocks turned lower.

Hopes for striking a deal were raised late in the week as comments from a key negotiator suggested that a deal might be getting closer to fruition. The week ended, however, without an agreement, cementing a disappointing week of performance.

Market sentiment was further weighed down by the continued rise in COVID-19 cases in the U.S. and Europe, though anxieties were tempered by the belief that a full economic lockdown was unlikely.

New Jobless Claims Fall

Markets have been focused on weekly initial jobless claims as an important input into the state of economic recovery. After weeks of 800,000+ new jobless claims, last week’s report reflected an improving labor market, as new jobless claims rose by 787,000, below consensus estimates of 875,000, while continuing jobless claims fell by more than one million. 4

The report wasn’t entirely positive, however, as more than 500,000 individuals were added to the emergency assistance program that extends unemployment benefits to those who have run out of state unemployment benefits. 5

TIP OF THE WEEK

When setting up a home based business, be sure to research whether your local zoning regulations permit it. The Small Business Administration’s website has an overview (Zoning Laws for Home-Based Businesses).

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: New Home Sales.

Tuesday: Durable Goods Orders. Consumer Confidence.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, October 23, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Twilio, Inc (TWLO).

Tuesday: Microsoft (MSFT), Pfizer (PFE), Caterpillar (CAT), Merck (MRK), Eli Lilly (LLY), 3M Company (MMM), Corning Inc. (GLW).

Wednesday: General Electric (GE), The Boeing Corporation (BA), Ford Motor Company (F), Visa (V), Mastercard (MA), Gilead Sciences (GILD), Blackstone Group (BX), Amgen (AMGN), United Parcel Services (UPS), EBay (EBAY), Norfolk Southern (NSC).

Thursday: Apple (AAPL), Facebook (FB), Twitter (TWTR), Alphabet, Inc. (GOOGL), Southern Company Airlines (SO), Shopify (SHOP), Comcast Corporation (CMCSA), AnheuserBusch InBev (BUD).

Friday: Abbvie (ABBV), Chevron (CVX), Charter Communications (CHTR).

Source: Zacks, October 23, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Getting people to like you is merely the other side of liking them.”

NORMAN VINCENT PEALE

THE WEEKLY RIDDLE

Three light switches are in the “off” position. Each connects to a light bulb in an adjoining room that you cannot see into. You can freely switch the light bulbs on and off, but you can only go into the adjoining room once to check on the state of the bulbs. Is it possible to tell which switch controls which bulb?

LAST WEEK’S RIDDLE: What should the last entry be in the following sequence of numbers: 9|18, 8|46, 7|94, 6|63, 5|52, 4|__?

ANSWER: Each sequence represents the square root of a number with digits reversed (9 is the square root of 81, 8 is the square root of 64, and so on). So the missing number is 61 (4 is the square root of 16).

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding a ny Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economi c instability and differences in accounting standards. This material represents an assessment of the market environment at a specif ic point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any p erson or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

- The Wall Street Journal, October 16, 2020

- The Wall Street Journal, October 16, 2020

- The Wall Street Journal, October 16, 2020

- CNBC.com, October 13, 2020

- CNBC.com, October 14, 2020