1% Moves in S&P 500

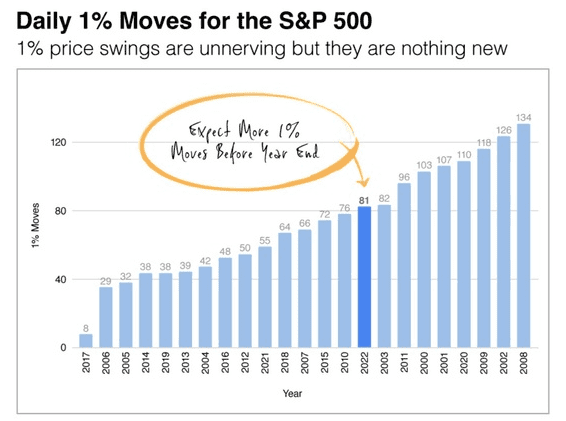

1% price swings are unnerving but they are nothing new.

Presented by Sterling Total Wealth Solutions

Source: CNBC.com, September 5, 2022

Source: CNBC.com, September 5, 2022

If you’ve felt like stock prices were a little more volatile in 2022 than in recent years, your “spidey senses” are right on the money.

The S&P 500 has posted 81 daily moves of at least 1% through August. Of those moves, 39 have been to the upside and 42 to the downside.

In this chart, we highlighted 2022 to show how it compares to other years since 2000. Since the daily report was compiled, stocks have seen a few more 1% swings. With more than 70 trading days left in the year, our hunch is we could see more.

What’s fueling the volatility? The Fed, largely. Its monetary policy of raising interest rates to slow inflation without triggering a recession has created a lot of uncertainty.

Price swings are unnerving, but as the chart shows, they are nothing new. What’s most important is focusing on your goals and not paying too much attention to Wall Street’s daily ups and downs. Of course, if you have any concerns or questions, we are always here for you.

The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com