In this week’s recap: Markets react to growing COVID-19 infections and potential successor to Powell.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |November 22, 2021

Click here to receive Economic Updates in your Inbox: Subscribe

THE WEEK ON WALL STREET

Stocks were mixed last week in choppy trading as investors battled the crosscurrents of good economic data and a troubling rise in COVID-19 infections globally.

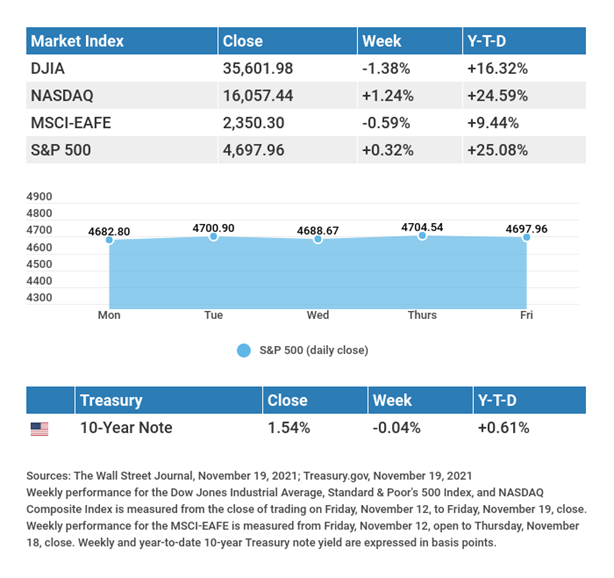

The Dow Jones Industrial Average slid 1.38%, while the Standard & Poor’s 500 added 0.32%. The Nasdaq Composite index gained 1.24% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, dropped 0.59%.1,2,3

TRADING UNCERTAINTY

A healthy retail sales report, falling jobless claims, positive earnings surprises, and strong manufacturing data lent support to stock prices, but investor sentiment was dampened by several concerns.

Chief among these worries are a resurgence of COVID-19 infections this winter and the impact inflation may have on consumer confidence and corporate profit margins. The uncertainty surrounding the renomination of Fed Chair Powell exacerbated this unease; a decision from President Biden may come soon. Technology and other high-growth companies led the market, while some of the reopening stocks, such as travel and energy, lagged.

RETAIL SALES JUMP

October retail sales increased 1.7%, indicating that consumers may be more confident than recent surveys have suggested. Sales of electronics, appliances, and autos were particularly strong last month.4

The market cheered the report, interpreting the results as a sign that inflation has not discouraged Americans from buying the products and services they want or need. This retail sales number, however, may be overstated for two reasons. First, higher prices increase the level of sales even if consumer demand is flat. Second, spending may have been pulled forward by consumer worries over higher future prices and concerns that goods may not be available during the holiday shopping season.

FINAL THOUGHT

We want to take this opportunity to wish you and your family a wonderful Thanksgiving, full of family, fun, and joy.

On this special day of gratitude, we would also like to express our appreciation to you for extending us the privilege of serving you this year and helping you pursue your important financial goals.

TIP OF THE WEEK

Avoid visiting ATMs alone at night, and never count your money at one. If an outside ATM seems lonely, try a well-lit ATM in a 24-hour grocery or drug store instead.

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: Existing Home Sales.

Tuesday: Composite PMI (Purchasing Managers’ Index) Flash.

Wednesday: Jobless Claims. Durable Goods Orders. Gross Domestic Product (GDP). New Home Sales. Consumer Sentiment. Federal Open Market Committee (FOMC) Minutes.

Source: Econoday, November 19, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Zoom Video Communications, Inc. (ZM).

Tuesday: Best Buy Co., Inc. (BBY), Dollar Tree, Inc. (DLTR), Dell Technologies, Inc. (DELL), Autodesk, Inc. (ADSK), Analog Devices, Inc. (ADI).

Wednesday: Deere & Company (DE).

Source: Zacks, November 19, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“The emblem of a philosophy is not that it contains a set of specific thoughts, but that it generates a way of thinking.”

SAMUEL R. DELANY

THE WEEKLY RIDDLE

The Cage family has a mother, father, and six sons, and each son has one sister. So, how many people are in this family?

LAST WEEK’S RIDDLE: An interesting occurrence happened about 25 minutes before 1 p.m. on May 6, 1978, involving numbers on the clock and months and years on the calendar. What was this numerically interesting moment?

ANSWER: Early that afternoon, the time and date read 12:34 on 5/6/78.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding a ny Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economi c instability and differences in accounting standards. This material represents an assessment of the market environment at a specif ic point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any p erson or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

- The Wall Street Journal, November 19, 2021

- The Wall Street Journal, November 19, 2021

- The Wall Street Journal, November 19, 2021

- CNBC, November 16, 2021