In this week’s recap: Happy New Year! Stocks hit record highs and have varied reactions on stimulus checks and another potential vaccine.

Weekly Market Commentary |Presented by Sterling Total Wealth Solutions |January 4, 2021

THE WEEK ON WALL STREET

Stocks moved higher during a holiday-shortened week of trading, capping off a turbulent, but otherwise strong year for equity investors.

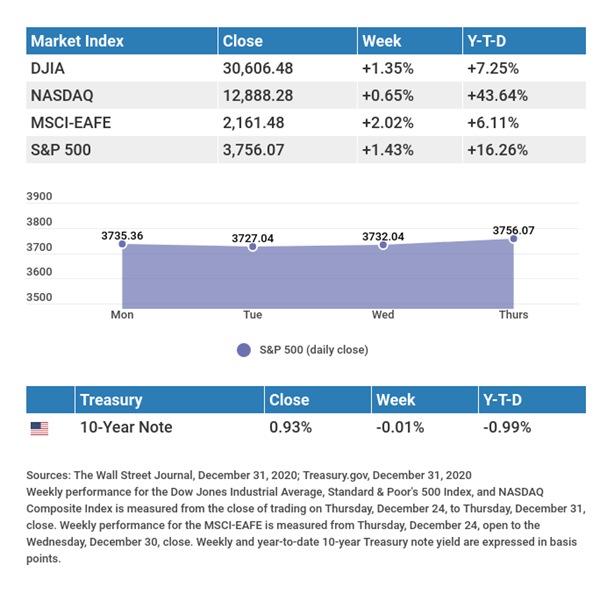

The Dow Jones Industrial Average gained 1.35%, while the Standard & Poor’s 500 increased by 1.43%. The Nasdaq Composite index, which led all year, added 0.65%. The MSCI EAFE index, which tracks developed overseas stock markets, rose 2.02%.1,2,3

Stocks End 2020 on a Positive Note

Stocks established fresh record highs last week, propelled by the signing of a COVID-19 relief bill, which delivered on a long-awaited, new round of economic stimulus and served to prevent a government shutdown in the near term.4

After pulling back on disappointment that the Senate was not able to increase individual stimulus payments to $2,000, stocks reversed direction as the approval of another vaccine by the U.K. lifted investor sentiment.

Ahead of the New Year holiday, stocks surged higher, leaving the Dow Jones Industrials Average and the S&P 500 Index to close 2020 at record highs.

The Unexpected IPO Boom

Companies raised over $167 billion in initial public offerings this year, blowing past the record of $107.9 billion set in 1999.5

This explosion in capital raising was one of the biggest surprises this year, especially considering the flight to safety in March and April. The introduction of unprecedented monetary easing played a critical role helping this flood of new issuance.

Also playing a role was the popularity of SPACs (Special Purpose Acquisition Corporations). A SPAC is a company that is formed to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company. SPACs accounted for almost half of the fundraising in the IPO market.6

Final Thoughts

We join all Americans in happily drawing the curtain on 2020. Though it was a challenging and tragic year for so many, there are good reasons to believe that 2021 will be a year of progress in returning to our pre-pandemic normal. We wish you and your family a healthy and happy new year!

TIP OF THE WEEK

If you’re thinking about selling a business, consider contacting a business broker, one that represents companies similar to yours. It may make finding an appropriate buyer easier.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Institute for Supply Management (ISM) Manufacturing PMI (Purchasing Managers Index).

Wednesday: Automated Data Processing (ADP) Employment Change, Factory Orders.

Thursday: Initial Jobless Claims, ISM Non-Manufacturing PMI.

Friday: Employment Report.

Source: Econoday, December 31, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Thursday: Micron Technologies (MU), Constellation Brands (STZ), Walgreens Boots (WBA), Conagra Brands (CAG).

Source: Zacks, December 31, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“To succeed in life, you need three things: a wishbone, a backbone, and a funny bone.”

REBA McENTIRE

THE WEEKLY RIDDLE

The railings on a 60-yard-long walkway have ornamental sculptures every 12 yards on both sides, starting at the east and west ends of the walkway. How many total sculptures are there on the walkway?

LAST WEEK’S RIDDLE: What number logically comes next in this series: 2, 3, 5, 9, 17, __.

ANSWER: 33. (The difference between the two numbers is progressively multiplied by 2 and added to the next number.)

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

CITATIONS:

- The Wall Street Journal, December 31, 2020

- The Wall Street Journal, December 31, 2020

- The Wall Street Journal, December 31, 2020

- FoxBusiness.com, December 29, 2020

- The Wall Street Journal, December 30, 2020

- The Wall Street Journal, December 30, 2020