Q1 Earnings: The Devil Is In The Details

Presented by Sterling Total Wealth Solutions

April 4, 2024

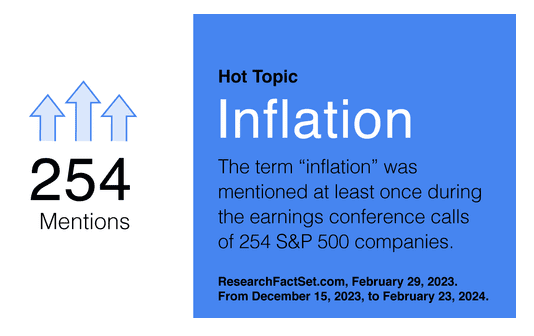

On financial websites, you may read, “First-quarter corporate reports were better than expected.” And that’s true. So far, 73% of Standard & Poor’s 500 companies have reported actual Q4 earnings per share above estimated earnings per share.1

On financial websites, you may read, “First-quarter corporate reports were better than expected.” And that’s true. So far, 73% of Standard & Poor’s 500 companies have reported actual Q4 earnings per share above estimated earnings per share.1

But the devil is in the details.

In Q4 2023, total S&P 500 earnings were projected to increase by almost $35 billion, or 7.4% from a year earlier. But let’s pull back the curtain and see what companies contributed the most and the least to that overall total.2

- The top 15 companies are projected to generate $61 billion in earnings, led by Nvidia ($10.6 billion) and Amazon ($10.3 billion). On a Y-over-Y basis, the top 15 will see earnings increase by 78%.2

- The middle 470 are expected to contribute $8.5 billion. Y-over-Y, a 2.6% increase on average.2

- The bottom 15 companies are projected to lose $35 billion, led by Pfizer (-$6.0 billion) and Citibank (-$4.2 billion). On a Y-over-Y basis, the bottom 15’s earnings will decline by 46.8%.2

What does it all mean? It’s a cautionary tale about the dangers of watching headlines—they summarize the key points but may overlook important details. We work with professionals who spend time analyzing S&P 500 earnings reports so we can bring the most up-to-date information to any discussions we have about your investment strategy.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Total Wealth Solutions and Cambridge are not affiliated.

To learn more about Sterling Total Wealth Solutions, visit us on the web at www.sterlingtotalwealthsolutions.com

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite.

CITATIONS

1. Insight.FactSet.com, February 16, 2024. “S&P 500 Earnings Season Update: February 16, 2024.” 395 companies in the S&P 500 have reported results as of February 16.

2. Fundstrat.com, February 26, 2024