Sterling Archived Articles

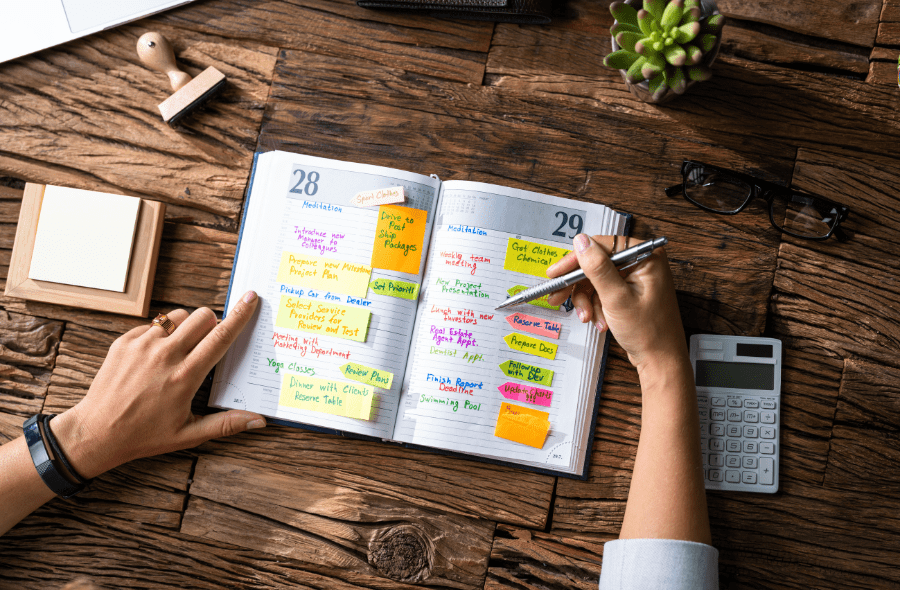

Personal Finance Calendar

Personal Finance CalendarPresented by Sterling Total Wealth SolutionsMay 14th, 2024January Get ready for a brand new year. Write down the major financial events you anticipate in the next few years. That will help guide a discussion about whether your portfolio...

Estate Management Checklist

Estate Management ChecklistPresented by Sterling Total Wealth SolutionsMay 13th, 2024Do you have a will? A will enables you to specify who you want to inherit your property and other assets. A will also enable you to name a guardian for your minor children. Do you...

The 5 Basics of Financial Literacy

From credit and debt to identity theft – read more about some of the key aspects of financial literacy.

The Financial Literacy Crisis

Many Americans are making financial decisions with minimal financial knowledge of investing, budgeting, and credit.

Winning The Lottery Every Day

Working with a financial professional can have you feeling like you’ve won the lottery every day.

Navigating Tax Season Safely

Beware of Pirates! Important reminders this tax season.

Achieving Financial Independence as a Couple

Here are some of our favorite time-tested strategies for maintaining open financial communication with one’s partner.

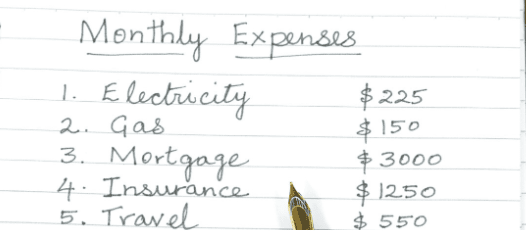

Budget Check Up: Tax Time Is the Right Time

A perfect time to take a critical look at how much money is coming in and where it’s all going.

What’s So Great About A Rollover?

Sit. Laydown. Rollover: The Rules, Guidelines, Dos, and Don’ts for IRA Rollovers.

Do Your Kids Know The Value of a Silver Spoon?

You taught them how to read and how to ride a bike, but have you taught your children how to manage money?